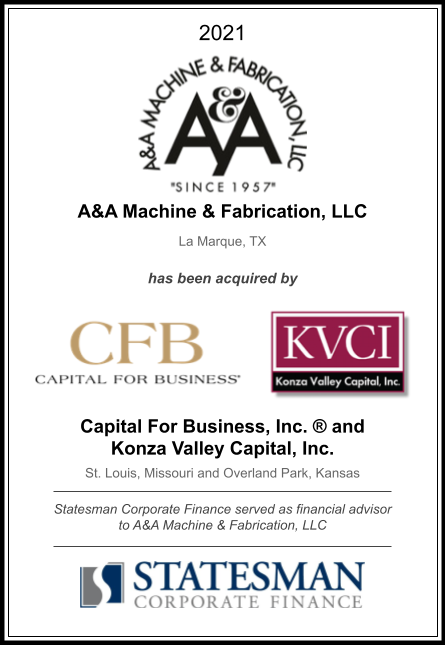

A&A Machine & Fabrication, LLC Has Been Acquired by Capital For Business, Inc. ® and Konza Valley Capital, Inc.

10.01.2022

HOUSTON, TEXAS (January 7, 2022) – Statesman Corporate Finance, LLC (“Statesman”) is pleased to announce the sale of A&A Machine & Fabrication, LLC (“A&A” and/or “the Company”), to Capital For Business, Inc. ® (“CFB”) and Konza Valley Capital, Inc. (“KVCI”). Statesman served as the exclusive sell-side financial advisor to A&A on the transaction.

A&A (based in La Marque, TX) is a manufacturer of mission-critical equipment used worldwide by manufacturers of plastic resins and synthetic gas (syngas). More specifically, A&A provides drawings, machining, welding, fabrication and installation of high-pressure tubular reactors and coolers, catalyst injection systems and other new and refurbished equipment, primarily for petrochemical plants and niche markets that support the production of low-density polyethylene (LDPE), polypropylene and products produced by gasification. A&A also provides a full range of engineering, repair services, field upgrades and system rebuilds.

“A&A interviewed four (4) transaction advisors and chose Statesman because of their intentional relationship building at the beginning. They became very interested in our business and came to know it well enough to market it. Statesman was so steady through the process and Jim Briggs with Philip Rodriguez make a fantastic team. The drive to finish is so critical and Statesman knows what to do in the last two minutes of the big game to get across the goal line. A&A is grateful for their expertise and guidance. We chose the right advisor, no doubt about it.” – Alan Hutchins, President & CEO.

Alan Hutchins further commented, “David Vasichko (co-owner) and I will continue in our current roles and over time begin strategically transitioning management to the established A&A leaders who have proven their expertise and commitment to our product lines. This transaction will enable AA to further expand its global presence and it creates incredible new opportunity for all of our employees.”

About the other transaction participants

Statesman Corporate Finance, LLC (Houston & Austin, TX) is the FINRA-licensed broker dealer affiliate of Statesman Business Advisors, LLC. With offices in Houston and Austin, Texas, Statesman is a leading middle-market investment banking firm providing merger and acquisition, capital formation, valuation, and other general corporate financial advisory services to middle-market companies. The Statesman team advising on this engagement was led by Jim Briggs, Director, and included Walter Tomlinson, Managing Member, Peter Chiu, Vice President, and Philip Rodriguez, Associate.

Capital For Business, Inc. ® (St. Louis, MO) is a private investment firm owned by Commerce Bancshares, Inc. focused on providing capital to middle-market businesses with proven management teams and a high potential for growth. Founded in 1959, CFB is one of the oldest small business investment companies (SBICs) in the nation, and has invested in numerous companies across a wide range of niche consumer, commercial, distribution, manufacturing, and service markets throughout the United States.

Konza Valley Capital, Inc. (Overland Park, KS) is a long-term capital solution provider for growth, wealth transfer and management transitioning of small to mid-sized companies. KVCI invests primarily in Midwestern-based companies, partnering with many successful companies in manufacturing, service, distribution, retail, and technology related industries.

McCullough Sudan, PLLC (Houston, TX) provided legal counsel to A&A led by Partners Phil Sudan, Doug McCullough, Aaron Woo, and Amy Akers.

Husch Blackwell LLP (St. Louis, MO) provided legal counsel to CFB and KVCI led by Partners Mary Anne O’Connell and Ashley L. F. Edwards, and Associate Jerry L. Thomeczek.