Mid-Atlantic Roofing Supply, Inc. Has Been Acquired by the Atlantic Squared Family of Brands

14.07.2021

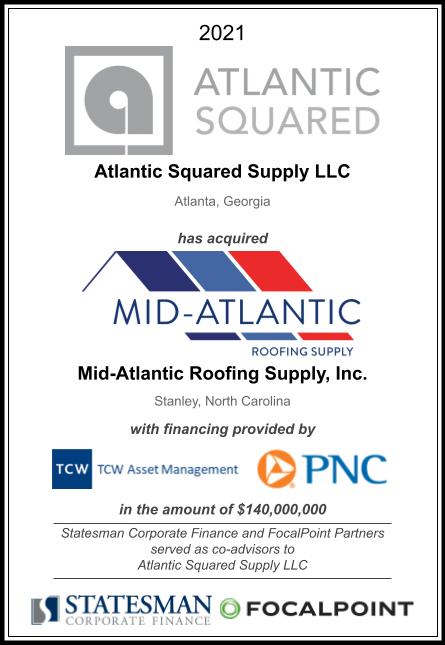

HOUSTON, TEXAS (July 14, 2021) – Statesman Corporate Finance, LLC (“Statesman”) is pleased to announce that Mid-Atlantic Roofing Supply, Inc. (“Mid-Atlantic”) has officially joined the Atlantic Squared family of brands (“Atlantic Squared”). The transaction that funded the acquisition was partially financed through a $140,000,000 senior credit facility consisting of a term loan facility from TCW Asset Management Company LLC (“TCW”) and a revolving line of credit from PNC Bank, N.A. (“PNC”). Statesman and FocalPoint Securities, LLC (“FocalPoint”) served as the exclusive financial advisors to the leaders of Atlantic Squared throughout the transaction, which closed May 28, 2021.

“Tim Perryman, President and CEO of Atlantic Squared, commented, “I first met Dave Sargent in 2006 when he helped lead the Roofing Supply Group (RSG) recapitalization. Dave and his team brought in Michael Brill and his FocalPoint team to co-advise on the financing, and Brian Sipes and his team at Kroll to complete the needed quality of earnings work. Without Dave’s leadership and network of advisors, along with the team’s professional and personal skills, this deal never would have happened.”“Tim and his team have done an amazing job in building Atlantic Squared’s original member Carolina Atlantic to the size it is today in less than three years, and the Mid-Atlantic acquisition is a perfect fit for Tim’s long growth strategy,” added David Sargent, Senior Advisor at Statesman.

About the other transaction participants

Statesman Corporate Finance, LLC (Houston & Austin, TX) is the FINRA-licensed broker dealer affiliate of Statesman Business Advisors, LLC. With offices in Houston and Austin, Texas, Statesman is a leading middle-market investment banking firm providing merger and acquisition, capital formation, valuation, and other general corporate financial advisory services to middle-market companies. The Statesman team advising on this engagement was led by Senior Advisor David Sargent, Director Gary Canon, Vice President Jessica Seff, and Associate Philip Rodriguez.

FocalPoint Securities, LLC (Chicago, IL) is an independent investment bank specializing in mergers and acquisitions, private placements, financial restructurings, and special situation transactions. With one of the largest dedicated Capital Markets teams in the middle market, they offer deep relationships with hundreds of lenders that allow them to navigate capital raise processes with confidence and precision.

TCW Asset Management Company LLC (Los Angeles, CA) is a leading global asset management firm with a broad range of products across fixed income, equities, emerging markets and alternative investments. With five decades of investment experience, TCW today manages approximately $248 billion in client assets. Through the MetWest Funds and TCW Funds families, TCW manages one of the largest mutual fund complexes in the U.S. TCW’s clients include many of the world’s largest corporate and public pension plans, financial institutions, endowments and foundations, as well as financial advisors and high net worth individuals.

PNC Bank, N.A. (Wilmington, DE) is a member of The PNC Financial Services Group, Inc. (NYSE: PNC). PNC is one of the largest diversified financial services institutions in the United States, organized around its customers and communities for strong relationships and local delivery of retail and business banking including a full range of lending products; specialized services for corporations and government entities, including corporate banking, real estate finance and asset-based lending; wealth management and asset management. For information about PNC, visit www.pnc.com.

Ward & Smith, P.A. (Raleigh, NC) provided legal counsel to Carolina Atlantic Roofing Supply LLC.

Goldberg Kohn (Chicago, IL) provided legal counsel to TCW.

Blank Rome LLP (Philadelphia, PA) provided legal counsel to PNC.

Duff & Phelps, a Kroll Business (New York, NY) provided pre-financing Quality of Earnings support to Carolina Atlantic Roofing Supply LLC.