GTI Holdings, LLC, has acquired Precision-Hayes International, Inc. from Actuant Corporation (NYSE: ATU)

07.01.2019

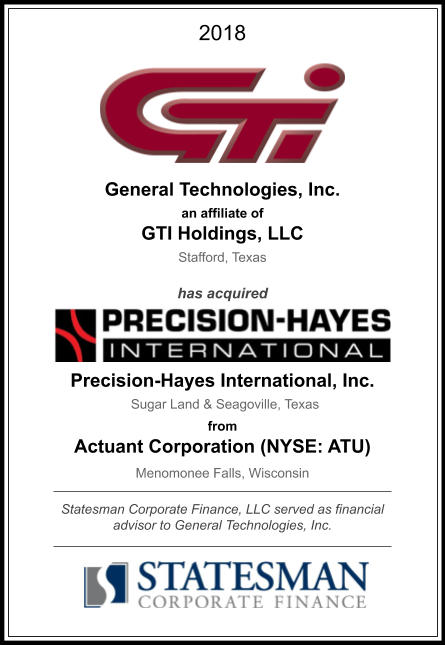

HOUSTON, TEXAS (January 7, 2019)– Statesman Corporate Finance, LLC (“Statesman”) is pleased to announce that GTI Holdings, LLC (“GTIH”) has acquired Precision-Hayes International (“PHI”) from PSL Holdings, Inc., a subsidiary of Actuant Corporation (NYSE: ATU). Statesman served as the exclusive financial advisor to GTIH and its subsidiary General Technologies, Inc. (“GTI”) throughout the transaction, which closed December 31, 2018.

GTI and PHI are two of the world’s leading organizations in the field of post-tensioning, a method of reinforcing concrete with high-strength steel strands or bars, concrete construction accessories, and related equipment. This transaction furthers GTI’s position as the premier worldwide source for technically advanced products in the concrete construction industry. Together, GTI and PHI will provide proprietary products, systems, and services that are unparalleled in facilitating safe, reliable, and quality construction.

“The GTI Team is pleased to bring together the two industry leading organizations. Our combined future is one of continued growth, quality achievements, and product innovation enabling our valued customers to reduce their costs and improve reliability and longevity of their systems”, said Felix Sorkin, President of GTI. “We also want to thank the Statesman team for their experienced guidance and support in assisting GTI complete this transaction. Their ability to assist with the required capital sourcing, negotiations, and due diligence was immeasurable.”

About the Transaction Participants

General Technologies founded in 1988 and located in Stafford, Texas, a suburb of Houston, GTI designs, develops, manufactures, and supplies specialty reinforcement systems and components for unbonded post-tensioning, bonded post-tensioning, concrete accessories, and related equipment, most of which is manufactured domestically in the company’s 300,000 sq. ft. CNC machine equipped and highly automated, state-of-the-art manufacturing facility. GTI’s products are used throughout the world in residential and commercial construction foundations, high-rise structures, parking garages, bridges, roads, containment structures, and other concrete buildings. With a multitude of US and worldwide patents, GTI’s technically-advanced products instill confidence with its broad, international customer base.

Precision-Hayes International, formerly a wholly owned subsidiary of Actuant Corporation (NYSE:ATU), provides a wide range of prestressed concrete products and solutions including anchorage and barrier products, a complete line of post-tensioning tools, plant production equipment and pre-tensioning components. The company is also a leading provider of engineered extrusions and coatings. PHI’s branded products are among the most recognized names in the industry and include SURE-LOCK®, POSI-LOCK, PocketShear®, and GRABB-IT®. PHI presently operates from two facilities, Sugar Land, Texas and Seagoville, Texas.

Statesman Corporate Finance advised GTI in this transaction and is the FINRA licensed broker dealer affiliate of Statesman Business Advisors, LLC. With offices in Houston and Austin, Texas, Statesman is a leading middle-market investment banking firm providing merger and acquisition, capital formation, valuation, and other general corporate financial advisory services to middle-market companies. The Statesman team advising on this engagement included Principal Will Jaco and Vice President’s Peter Chiu and Jessica Seff.

Comerica Bank (Houston, TX), Independent Bankers Capital Fund (Dallas, TX), and Diamond State Ventures (Little Rock, AR) jointly provided the financing for the transaction.

Hunton Andrews Kurth, Zukowski, Bresenhan & Piazza, and Adolph Locklar collectively represented GTI on transnational, real estate, IP, tax, employment, environmental, and other legal matters. Clark Hill represented Actuant Corporation.

Harper Pearson and Moss Adams provided accounting, tax, and due diligence support on behalf of GTI and its lenders.